Now offering up to 4.00% p.a. interest on savings accounts.

Learn more about itInfo@ucassettrust.com

Info@ucassettrust.com

Now offering up to 4.00% p.a. interest on savings accounts.

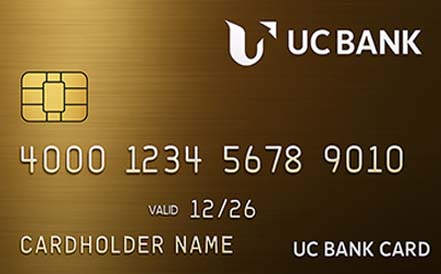

Learn more about itUCBANK's business credit cards are tailored to support your company’s growth. Whether you're managing everyday expenses or expanding operations, our cards give you the control and flexibility you need to thrive.

Enjoy simplified financial management, competitive rewards, and robust security — all in one powerful tool.

From streamlined purchasing to detailed reporting and employee card options, our business cards are built with your success in mind.

Get a generous cashback or points bonus when you spend a set amount within the first few months — a great head start for your business expenses.

Track, categorize, and manage employee spending with detailed monthly statements and real-time transaction alerts.

Save on business travel with fuel surcharge waivers at major fuel stations nationwide — no hidden fees.

Our business banking solutions are designed to give you flexibility, transparency, and control — whether you’re managing daily operations or planning long-term growth.

Track and categorize business expenses with detailed monthly statements and real-time insights.

Assign cards to team members with preset limits to control company spending effortlessly.

Sync your account with accounting platforms like QuickBooks or Xero for efficient bookkeeping.

Access a dedicated support line for faster assistance on all your business banking needs.